Best Bookkeepers in Sioux Falls South Dakota Bookkeeping Services

All accountants listed are well-versed in the challenges of construction accounting, including tax regulations, certified payroll laws and more. QuickBooks Setup – And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited. Once we have everything set up, we’ll complete a month of your bookkeeping. Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books.

WHEN IMAGE AND ACCOUNTABILITY MATTER MOST, MINUTEMAN LLC HAS THE TRUSTED SERVICES YOU NEED

Bid farewell to mountains of paperwork and tedious manual record keeping in Sioux Falls, South Dakota—we automate entries directly from your linked accounts. Gain insights from a single, central dashboard to easily comprehend the health of your business and make informed, strategic decisions. Perfectly tailored for the dynamic and growing businesses of Sioux Falls, South Dakota, embrace simplicity and strategy with Bench bookkeeping services. We are South Dakota’s best construction accounting software for contractors who want to transform their business. Experience the power of construction-focused accounting software that understands your business inside and out.

- South Dakota is home to several large construction projects that are excellent opportunities for contractors to take advantage of.

- In the dynamic landscape of contemporary business, the significance of proficient bookkeeping cannot be overstated.

- ELO CPAs & Advisors’ team of building sector industry experts offers the services, strategies and experience to create a strong financial foundation for good years and for bad years.

- By developing a careful reporting system, we can identify cash flow issues and strategize ways to improve your profits.

- At Remote Books Online, we are committed to safeguarding your business’s financial integrity and reputation, providing you with peace of mind during this critical phase.

What Software Can Manage Change Orders and Keep Track of Budgets for Construction Projects?

We understand the critical importance of having actionable data at your fingertips, which is why our reports are meticulously crafted to provide you with a detailed analysis of your financial status. By relying on our reports, you gain a competitive edge, enabling you to identify opportunities for growth, The Role of Construction Bookkeeping in Improving Business Efficiency optimize resource allocation, and drive profitability. Trust in our expertise to empower your business with the financial intelligence it needs to thrive.

Industry Performance

We try our best to keep you with the bookkeeping team you’re assigned when you come on board. If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Contributing to causes you care about not only supports your community and passions but can also offer significant tax benefits. Explore tips on financial readiness, team resilience and festive traditions to close out the year.

What Are The Best Alternatives to QuickBooks® for Construction?

So, invest in the expertise of professional bookkeepers and watch your business thrive. Before we embark on an exploration of the advantages that Remote Books Online offers as your preferred bookkeeping ally in the state of South Dakota, it is crucial to comprehend the pivotal role that bookkeeping plays in the realm of business. Bookkeeping stands as the bedrock of financial management for any enterprise. It serves as the meticulous record-keeping process that meticulously tracks and documents all financial transactions, enabling businesses to maintain a clear, accurate, and up-to-date financial picture. This encompassing financial clarity forms the basis for sound decision-making, strategic planning, and compliance with tax regulations.

- This meticulous attention to detail not only ensures compliance with financial regulations but also empowers you to make well-informed business decisions.

- He has extensive knowledge of transportation, retail and service industries.

- Experience the power of construction-focused accounting software that understands your business inside and out.

- You can also search online directories such as the QuickBooks ProAdvisor directory or state/national accounting associations.

- I provide virtual bookkeeping services based in the United States, so I can work with you regardless of physical location.

- The resulting destruction to you, your crew, your company and the poor family whose home you are working on would be extremely expensive.

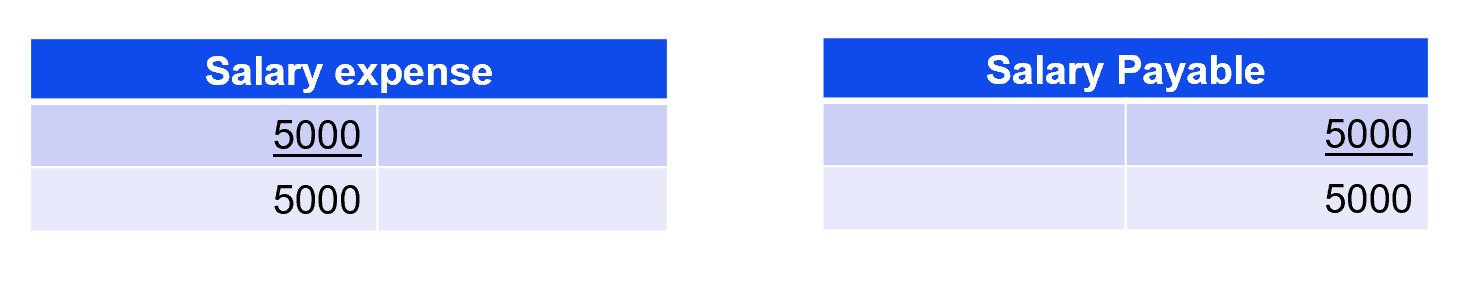

Bank Reconciliation

Ensure the utmost accuracy and integrity in your financial records by leveraging our comprehensive bank reconciliation services. Our dedicated team of financial experts meticulously scrutinizes your bank statements and meticulously aligns them with your books, leaving no room for discrepancies or errors. With our specialized approach, you can rest assured that your financial data is in perfect harmony, allowing you to make informed decisions with confidence. Trust us to streamline your financial management, enhance transparency, and maintain a clear financial picture for your business. Don’t compromise on precision – choose our bank reconciliation services and experience financial peace of mind. https://digitaledge.org/the-role-of-construction-bookkeeping-in-improving-business-efficiency/ A Collection Of Smaller Cubes – Which are processes that work together in a synergistic effect in harmony to form a fast and easy predictable outsourced accounting and outsourced bookkeeping system that is Process Dependent, Not People Dependent.

Xero Outsourced Construction Accounting Services

- Back bookkeeping services help you get fully caught up with tax-ready financials in less than a week.

- QuickBooks Live Bookkeeping offers online bookkeeping services that connect small businesses with trusted, QuickBooks virtual bookkeepers.

- Remote Books Online’s web service means we don’t have to be local to provide you with unmatched service and response.

- Perfectly tailored for the dynamic and growing businesses of Sioux Falls, South Dakota, embrace simplicity and strategy with Bench bookkeeping services.

- No business is too big, too small, or too unique for our monthly bookkeeping service.

This is an efficiency ratio, which indicates the average liquidity of the inventory or whether a business has over or under stocked inventory. This ratio is also known as “inventory turnover” and is often calculated using “cost of sales” rather than “total revenue.” This ratio is not very relevant for financial, construction and real estate industries. IBISWorld provides industry research on thousands of industries around the world. Our clients rely on our information and data to stay up to date on business and industry trends across all sectors of the economy. This industry report includes thoroughly researched, reliable and current information that will help you make faster, better business decisions. I love running my own business because it allows me the time and flexibility to sit down with clients, get to know them, and provide an honest assessment of how I can help.